The digital euro: What will change in 2029?

The digital euro is getting closer, a new digital form of money issued by the European Central Bank (ECB). It is designed to complement, not replace, cash and existing electronic money. In October 2025, the ECB finalized its preparation phase and decided to move ahead with developing the digital euro.

What is the digital euro?

The digital euro is an additional way to make payments in the future. Today, we use two types of money: commercial money and public money.

- Commercial money, also known as bank money which refers to the funds in your bank account, issued by commercial banks.

- Public money, also known as cash, which refers to the banknotes and coins issued by the European Central Bank (ECB) and national central banks

The digital euro would also be public money, just like cash, but existing in purely digital form. Unlike commercial bank deposits, which depend on the solvency of private banks, digital euros would be a direct claim on the ECB. It is therefore classified as a central bank digital currency (CBDC): a new, digital payment option backed by the ECB and accessible to everyone in the euro area.

Why does the ECB think this is necessary?

- It makes European payments more independent from companies outside the EU, strengthening Europe’s strategic autonomy by enabling more payments to be processed through European systems.

- It ensures that people across the EU can make digital payments anywhere.

- It enables new payment options, for example, paying with your phone even when you’re temporarily offline.

Last but not least

It also responds to the rise of stablecoins, digital tokens whose value is linked to a stable reference such as the euro, the dollar, or gold. Stablecoins aim to avoid the high price volatility seen in other cryptocurrencies like Bitcoin or Ethereum.

Although the digital euro will not be introduced until 2029, this new form of digital money could have major implications for the tracing of digital transactions. Want to learn more about how crypto transactions can be traced? Contact ‘’crypto@dataexpert.nl’’ for a free tracing assessment.

Our experts assist private individuals, financial institutions, and law enforcement agencies in analyzing and tracing crypto transactions, for example in cases of scams, fraud, or questions about the origin of crypto assets. Using advanced blockchain tools and years of experience, we map financial flows and deliver detailed, visual reports.

What are the risks and key considerations?

While the digital euro offers opportunities, it also raises several challenges:

- Privacy: concerns about how payment data will be stored and used.

- Cybersecurity: protection against hacking and system failures.

- Impact on banks: shifting deposits could put pressure on commercial banks, so a holding limit is likely to be introduced.

- Programmability of money: There is much debate about whether digital money could be programmable, meaning it could in theory be designed for specific uses or time limits.

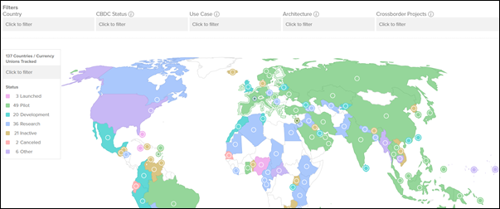

Which countries already have a CBDC?

Several countries have already launched a central bank digital currency. Examples include:

- The Bahamas, with the Sand Dollar;

- Nigeria, with the eNaira;

- Jamaica, with the Jam-Dex.

A continuously updated overview of CBDC initiatives worldwide can be found via the Atlantic Council’s CBDC Tracker.

By Erwin Heuvelman | November 17, 2025